Invoice factoring has emerged as a strategic financial tool for CFOs in Bangladesh, offering immediate liquidity solutions and enhancing cash flow management. This article explores the concept of invoice factoring, its benefits for businesses in Bangladesh, implementation considerations, and future trends.

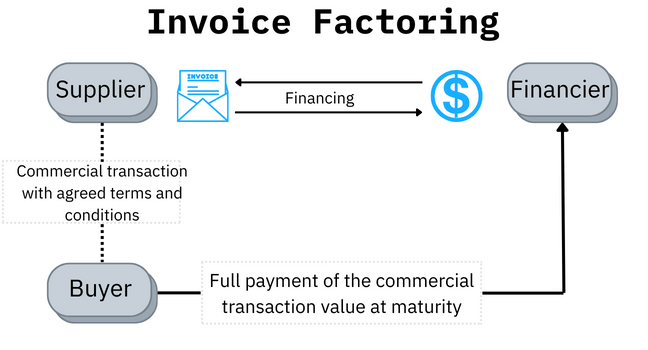

Invoice factoring, also known as accounts receivable financing, involves selling unpaid invoices to a third-party financial institution (factor) at a discounted rate. This enables businesses to convert accounts receivable into immediate cash, improving liquidity and funding working capital needs without waiting for customer payments.

In Bangladesh, where cash flow management is critical for business sustainability, invoice factoring provides significant advantages. It offers predictable and reliable cash flow, enabling CFOs to meet operational expenses, invest in growth initiatives, and seize business opportunities without relying on traditional bank loans or overdraft facilities.

The process of invoice factoring is straightforward. Once a company sells its invoices to a factor, typically at a discount ranging from 1% to 5% of the invoice value, the factor advances a percentage of the invoice value (often around 80% to 90%) to the company upfront. The remaining balance, minus the factoring fee, is paid to the company when the customer settles the invoice in full.

Benefits of invoice factoring extend beyond immediate cash flow enhancement. It helps businesses manage credit risk and reduce bad debt exposure by transferring the responsibility of collecting payments to the factor. This allows CFOs to focus on core financial management activities and strategic decision-making rather than chasing overdue invoices.

Implementation of invoice factoring in Bangladesh requires consideration of several factors. These include the cost of factoring services, which varies based on factors such as invoice volume, creditworthiness of customers, and the industry sector. Companies should also assess the reputation and reliability of potential factoring partners to ensure smooth and transparent transactions.

Success stories of businesses in Bangladesh highlight the transformative impact of invoice factoring on financial stability and growth. Companies across various sectors, including manufacturing, services, and trading, have leveraged invoice factoring to optimize cash flow, improve supplier relationships, and fuel expansion initiatives.

Looking ahead, the future of invoice factoring in Bangladesh appears promising. As businesses increasingly recognize the benefits of alternative financing solutions, the demand for invoice factoring is expected to grow. Technological advancements, such as digital platforms and automated processes, are also likely to streamline factoring transactions and reduce costs.

In conclusion, invoice factoring presents a strategic opportunity for CFOs in Bangladesh to optimize cash flow, mitigate credit risks, and accelerate business growth. Embracing invoice factoring not only addresses immediate financial needs but also positions companies for long-term financial stability and competitiveness in the evolving marketplace.